Launching a company or steering one through a merger, turnaround, or major transition requires clarity about how value will be created and, just as importantly, how revenue will actually be generated.

Many leadership teams recognize the need for a Business Plan, but overlook that sustainable growth requires a second, complementary plan. The main breakdown is not the strategy itself, but the assumption that strategy automatically creates revenue. Bridging strategy and revenue requires a distinct plan for that conversion, targeting a different audience.

The Business Plan sets direction from the top down. The Sales Plan is validated by demonstrating how that direction can become actual revenue from the bottom up.

Both are essential. Neither works in isolation.

The Business Plan: Charting the Course (Top-Down)

The Business Plan exists to answer specific questions for a particular audience. Its primary readers are CEOs, CFOs, bankers, private equity partners, and venture investors. These stakeholders are evaluating risk, scale, and return. They want to know where the company is going and why the destination is worth the journey.

At its core, the Business Plan articulates strategic intent. It defines the mission, the long-term objectives, and the differentiated value proposition that the company believes the market will reward. It frames the opportunity in language that aligns leadership, capital, and governance.

Market analysis in this context is necessarily high-level. It focuses on the total addressable market, industry dynamics, competitive positioning, and macro trends. The goal is not to explain how every deal will be won, but to establish that a meaningful opportunity exists and that the company has a credible right to pursue it.

Financial projections follow the same logic. They are built on broad assumptions: projected market share, average selling price, renewal and retention rates, inflation, and multi-year revenue targets. These numbers are directional. They signal ambition and scale rather than operational certainty.

Operational structure rounds out the picture. The Business Plan outlines the organizational model required to execute the strategy:

- Key roles,

- Leadership responsibilities,

- The governance needed to support growth.

This is about confidence and coherence, not headcount math.

What the Business Plan does exceptionally well is establish belief. It creates alignment at the leadership and investor levels around the business’s intended future.

What it does not do is guarantee that revenue can be produced on schedule, at cost, or at scale.

The Sales Plan: Planning to Grow (Bottom-Up)

The Sales Plan exists to answer a different question entirely: Can this strategy actually be executed with real customers, real people, and real constraints? Its audience is the sales leader and the operational teams responsible for generating revenue. Where the Business Plan speaks in outcomes, the Sales Plan speaks in mechanisms.

The Sales Plan’s primary function is validation. It tests whether the assumptions embedded in the Business Plan hold up when translated into day-to-day execution. This starts with a concrete go-to-market strategy. Channels are specified rather than implied. Lead sources are defined. Pricing models are pressure-tested against buyer behavior rather than market theory.

Customer definition becomes precise. The Ideal Customer Profile is a realistic view of the buying process that encompasses pain points, decision triggers, buying committees, and procurement dynamics. Here, the Sales Plan must also clarify how the sales process will educate buyers:

- address misconceptions,

- guide decision-making,

- build understanding so that optimism meets informed customer friction.

From there, the plan becomes granular by necessity. Revenue targets are decomposed into the activity and resources required to achieve them. Headcount plans detail how many salespeople are needed, when they will be hired, how long it will take them to ramp, and what productivity will look like over time.

Pipeline math is explicit: marketing leads, meetings, proposals, and conversion rates are modeled. Assumptions and constraints are addressed head-on rather than ignored.

The Sales Plan is uncomfortable for teams that prefer abstraction. It exposes gaps quickly. That is precisely its value.

Meeting in the Middle: Where Strategy Becomes Real

The real power of these two plans lies in their design to meet in the middle rather than compete for authority.

Alignment is the first benefit. When the Business Plan’s strategic narrative is grounded in the Sales Plan’s execution reality, messaging becomes consistent and credible. The brand’s promises align with sales conversations, and market expectations can be met.

Budgeting becomes disciplined rather than political. A bottom-up Sales Plan enables sales leadership to calculate the actual cost of building the revenue engine outlined in the Business Plan. Hiring, enablement, tooling, and support costs are requirements, not estimates.

Adaptability improves as well. The Business Plan provides a framework for strategic pivots when markets shift or assumptions change. The Sales Plan enables tactical adjustments based on real-time buyer feedback. Together, they foster resilience rather than rigidity.

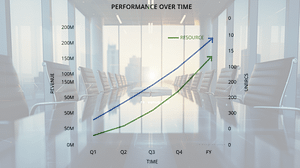

Performance tracking also sharpens. The Business Plan monitors progress toward long-term milestones

- market penetration,

- valuation,

- enterprise value creation.

The Sales Plan tracks what is happening now:

- conversion rates,

- deal velocity,

- customer experience,

- retention signals.

One keeps leadership oriented; the other keeps the business alive.

Risk Mitigation Through Validation

Perhaps the most underappreciated role of the Sales Plan is its function as a flaw detector.

When built honestly, a bottom-up sales model reveals disconnects in the Business Plan before they become expensive failures. It surfaces assumptions about pricing, sales cycles, staffing, or buyer readiness that don’t hold up under scrutiny. Catching those issues early can save millions in wasted spend, missed growth targets, or damaged valuations.

Operational teams benefit as well. Accurate sales forecasts inform manufacturing schedules, inventory planning, and supply chain decisions. Operations stops reacting to surprises and starts intentionally supporting growth.

This is where strategy earns credibility internally. When sales forecasts are grounded, the rest of the organization can plan with confidence.

The Real Verdict

Market research, competitive analysis, and financial modeling are essential. They build the business case.

But growth doesn’t happen because the spreadsheet works. It occurs when someone translates intent into execution and builds the infrastructure to support it.

The Business Plan defines where the company wants to go. The Sales Plan tests and confirms that the company can get there in practice.

Organizations confuse vision for viability if they treat these as substitutes. Respecting each plan’s unique role and aligning them reduces risk, accelerates learning, and fosters deliberate growth.